nassau county tax rate calculator

The Nassau County sales tax rate is 425. Nassau County FL Property Appraiser.

Exchanger Https Www Paymentbase Com Money Online Sovereign Adsense

Sales taxes for a city or county in New York can be as high as 475 meaning you could potentially pay a total of 875 sales tax for a vehicle in.

. For comparison the median home value in. The minimum combined 2022 sales tax rate for Nassau County New York is 863. Download all New York sales tax rates by zip code The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc.

Method to calculate Nassau sales tax in 2021. For example the sales tax rate in Yonkers is 8875 whereas the rate in the county in which it is located - Westchester - is 8375. Nassau County uses a simple formula to calculate your property taxes.

The New York state sales tax rate is currently 4. NYS MORTGAGE TAX RATES County Tax Rate Zone _ County Tax Rate Zone Albany 100 2 Niagara 100 1 Allegany 100 1 Oneida 100 1. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

The December 2020 total local sales tax rate was also 8625. For comparison the median home value in. You can find more tax rates and allowances for Nassau County and New York in the 2022 New York Tax Tables.

The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Nassau County. Nassau County in Florida has a tax rate of 7 for 2022 this includes the Florida Sales Tax Rate of 6 and Local Sales Tax Rates in Nassau County totaling 1. Nassau County New York Property Tax Go To Different County 871100 Avg.

The 2018 United States Supreme Court decision in. Compare your rate to the New York and US. Nassau County Sales Tax Rates for 2022 Nassau County in New York has a tax rate of 863 for 2022 this includes the New York Sales Tax Rate of 4 and Local Sales Tax Rates in Nassau County totaling 463.

Then they calculate the tax rates needed to. How much is property tax in Nassau County NY. Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford. The budgettax rate-determining exercise generally entails regular public hearings to debate tax. Calculate how much youll pay in property taxes on your home given your location and assessed home value.

Nassau County Tax Lien Sale. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Assessment Challenge Forms Instructions.

How much is property tax in Long Island NY. This is the total of state and county sales tax rates. Nassau County has introduced an online school property tax calculator to help homeowners estimate their October tax bills in response to the sticker.

NASSAU COUNTY ASSESSMENT REVIEW COMMISSION. As calculated a composite tax rate times the market value total will show the countys entire tax burden and include individual taxpayers share. How to Challenge Your Assessment.

You can find more tax rates and allowances for Nassau County and Florida in the 2022 Florida Tax Tables. Under the county level almost all local governments have arranged for Nassau County to bill and collect the tax. Our Florida Property Tax Calculator can estimate your property taxes based on similar properties.

Do Your Due Diligence Or Let Us Do it For You How do you prorate taxes for closing. Claim the Exemptions to Which Youre Entitled. Rate Calculator Enter the appropriate values below and then click on Calculate to view the calculations.

Nassau County collects on average 179 of a propertys assessed fair market value as property tax. Nassau County NY Sales Tax Rate Nassau County NY Sales Tax Rate The current total local sales tax rate in Nassau County NY is 8625. Rules of Procedure PDF Information for Property Owners.

69 rows Nassau County New York Sales Tax Rate 2022 Up to 8625 The Nassau County Sales Tax is 425 A county-wide sales tax rate of 425 is applicable to localities in Nassau County in addition to the 4 New York sales tax. The Delaware sales tax rate is 0 the sales tax rates in cities is also 0. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900.

Some cities and local governments in Nassau County collect additional local sales taxes which can be as high as 0375. The Sales tax rates may differ depending on the type of purchase. Assessed Value AV x Tax Rate Dollar Amount of Taxes.

STIPULATION OF SETTLEMENT CALCULATOR. Some cities and local governments in Nassau County collect additional local sales taxes which can be as high as 05. Choose a tax districtcity from the drop-down box selections include the taxing district number the name of the districtcity and the millage rate used for calculation Enter a market value.

Thus its mainly just budgeting first establishing a yearly expenditure amount. Every entity establishes its own tax rate. 179 of home value Yearly median tax in Nassau County The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Nassau County Florida Sales Tax Rate 2022 Up to 75 The Nassau County Sales Tax is 1 A county-wide sales tax rate of 1 is applicable to localities in Nassau County in addition to the 6 Florida sales tax.

Nassau County Property Tax Reduction Tax Grievance Long Island

Property Taxes In Nassau County Suffolk County

Bankruptcy Attorney New York Nassau Suffolk County Of Long Island Accounting Firms Accounting Services Tax Season

Property Tax How To Calculate Local Considerations

5 Fall And Winter 2021 Home Decor Trends To Help Your Listings Stand Out Trending Decor Home Decor Trends 2021 Home Decor Trends

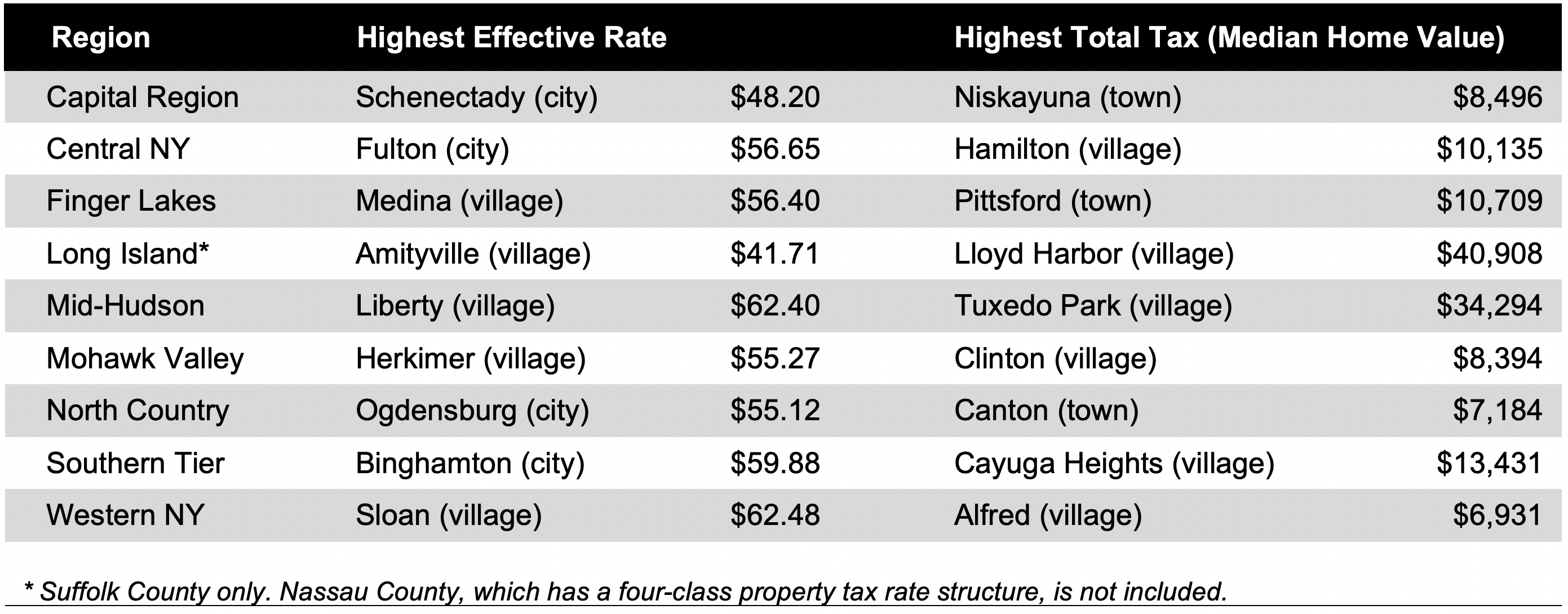

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Nassau County Property Tax Reduction Tax Grievance Long Island

Exchanger Https Www Paymentbase Com Money Online Sovereign Adsense

2021 City Cost Of Living Index Cost Of Living Tunisia Africa Saint Vincent And The Grenadines

Property Taxes In Nassau County Suffolk County

Property Taxes In Nassau County Suffolk County

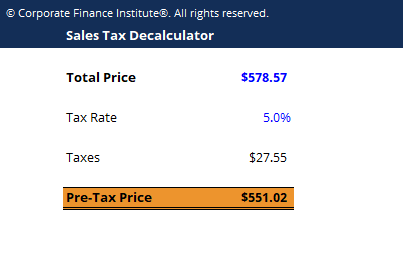

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Make Sure That Nassau County S Data On Your Property Agrees With Reality

How To File Previous Year Taxes Online Priortax Online Taxes Previous Year Tax

Transfer Tax Calculator 2022 For All 50 States

New York Property Tax Calculator 2020 Empire Center For Public Policy

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

5 Unexpected Benefits Of Working With A Real Estate Wholesaler In Lorain Sell My House Fast Selling Your House Sell Your House Fast